One Up on Wall Street PDF is a book by Peter Lynch and was first published in 1989 by Simon & Schuster. The book tells the story of Lynch’s investment career with Fidelity Investments, during which time he averaged a 29.2% annual return. Over the course of his 13 years as portfolio manager of the Magellan Fund, Lynch’s annual returns never dipped below 10%.

The book explores the major theme that anyone can become a successful investor by following some simple advice, and provides tips on how to pick stocks. It also gives an overview of the investment process and common pitfalls.

One Up on Wall Street sold over 1.5 million copies and was on The New York Times Best Seller list for 29 weeks. The book has been translated into 12 languages and is available in audio and Kindle formats.

Critics have praised the book for its clear and concise explanations of investment concepts, as well as its humor and Lynch’s down-to-earth style. One Up on Wall Street is considered one of the most important investment books of all time.

Table of Contents

One Up on Wall Street Summary

The book is a guide to investing in the stock market for the layperson. Lynch, who was the manager of the Magellan Fund at Fidelity Investments, is considered one of the most successful money managers of all time.

In the book, Lynch outlines his investing philosophy and provides advice on how to pick stocks. He also shares stories of some of his most successful investments, including Apple, Hanes, and General Electric. Rothchild, who was a journalist for Time magazine, served as the ghostwriter for the book.

As the book progress, Lynch describes how he developed his investing philosophy and how he goes about finding stocks that are undervalued by the market. He shares stories of some of his most successful investments, including Apple, Hanes, and General Electric. He also provides advice on how to pick stocks and manage a portfolio.

Lynch’s investment philosophy is based on the belief that the stock market is efficient in the long run, but in the short run, it is often irrational. This means that there are opportunities to find stocks that are undervalued by the market and to profit from them.

Details of One Up on Wall Street Book

| Book | One Up on Wall Street |

| Author | Peter Lynch, John Rothchild |

| Original language | English |

| Originally published | 1989 |

| Category | Biography |

| Publisher | Simon & Schuster |

| Total Pages | 318 |

| Format | PDF, ePub |

Multiple Languages Editions of One Up on Wall Street Book

One Up on Wall Street book has been translated into multiple languages, making it accessible to a wider audience. The book has been translated into Chinese, Japanese, Korean, and Spanish.

| Book Editions | Check Now |

|---|---|

| English | Check Price |

| Hindi | Check Price |

| Portuguese | Check Price |

| Chinese | Check Price |

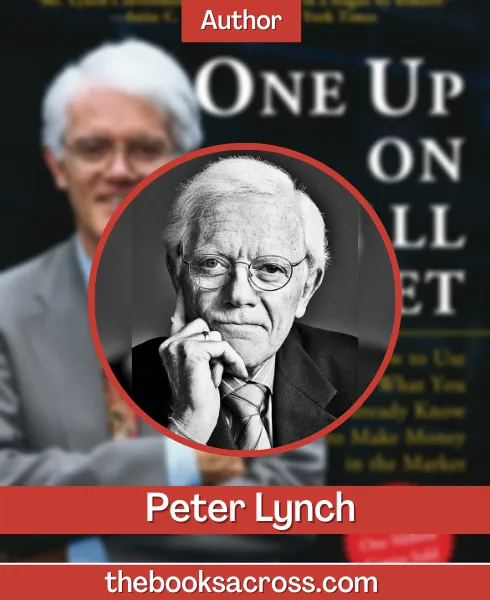

About the Author

Peter Lynch and John Rothchild are the authors of One Up on Wall Street book. Peter Lynch is considered one of the most successful money managers of all time. He is the manager of the Magellan Fund at Fidelity Investments. Lynch is the author of a number of books on investing, including “One Up on Wall Street.”

Peter Lynch was born in 1944 in Boston, Massachusetts. He graduated from the Wharton School of Business in 1968 and went to work for Fidelity Investments. Lynch is the manager of the Magellan Fund at Fidelity Investments. He is considered one of the most successful money managers of all time.

John Rothchild is a journalist for Time magazine. He served as the ghostwriter for “One Up on Wall Street.” He was born in 1944 in Boston, Massachusetts. Rothchild graduated from the University of Wisconsin in 1966. He has been a journalist for Time magazine since 1969.

The main purpose of the authors writing this book is to share their investment philosophy and provide advice on how to pick stocks. They want to help laypeople understand the stock market and make money from it.

One Up on Wall Street PDF Free Download

If you are looking for a pdf file of the One Up on Wall Street book, it is available here for free to download. Just click on the download button below.

Similar Books to One Up on Wall Street Book

- The Intelligent Investor by Benjamin Graham

- The Warren Buffett Way by Robert G. Hagstrom

- Beating the Street by Peter Lynch

- The Essays of Warren Buffett: Lessons for Corporate America by Lawrence A. Cunningham

- The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success by William N. Thorndike, Jr.

- Value Investing: From Graham to Buffett and Beyond by Bruce Greenwald, Judd Kahn, Paul D. Sonkin, Michael van Biema

- Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Companies by Tobias E. Carlisle

FAQs(Frequently Asked Questions)

Is One Up on Wall Street a good book?

One Up on Wall Street is considered a classic investing book. It was written by Peter Lynch, who is considered one of the most successful money managers of all time.

What does One Up on Wall Street teach you?

The book teaches Lynch’s investment philosophy and provides advice on how to pick stocks. It also shares stories of some of his most successful investments, including Apple, Hanes, and General Electric.

Who should read One Up on Wall Street?

The book is intended for laypeople who want to learn about the stock market and how to make money from it.

How long is the One Up on Wall Street pdf?

One Up on Wall Street pdf is 320 pages long.